Hope through Housing Foundation celebrated financial literacy month with programs and events educating our residents on the importance of financial planning for a secure financial future.

Over four weeks, we held 28 financial literacy workshops across the Inland Empire, Los Angeles/Orange County and San Diego.

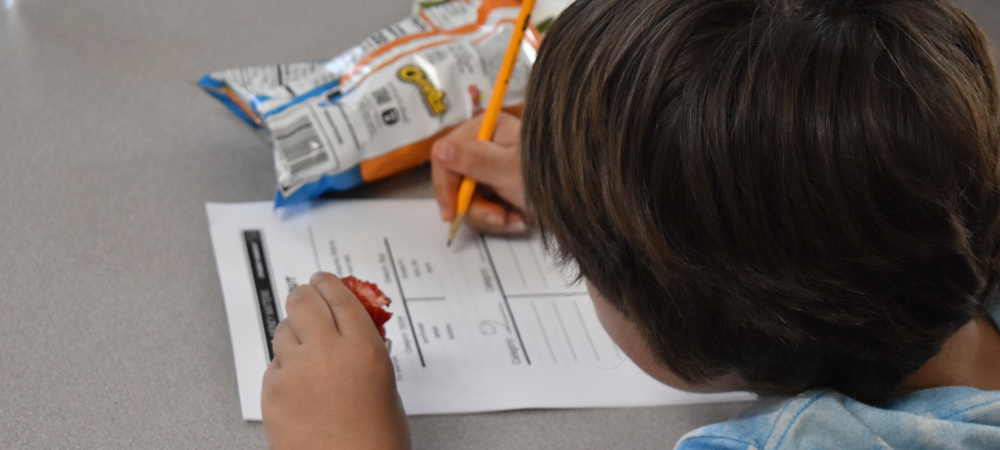

In 23 adult workshops and five focused on youth, residents gained knowledge on all things financial, such as credit, managing debt, budgeting and much more.

With most of our residents earning between 30% and 80% of the median area income, a lack of access to financial education has made it difficult break the generational cycle of poverty. Financial literacy equips people with the knowledge and skills to effectively manage money to ensure stability even in times of crisis.

Financial education also helps youth achieve financial well-being in their adult lives. Through our Building Bright Futures program, Hope through Housing helps youth achieve success with activities that support academic enrichment and build healthy habits. Children who learn to save develop strong lifelong financial behaviors and, as adults, have more assets and less debt.

We also strive to improve families’ well-being through our Pathways to Economic Empowerment initiative, which includes strategies for overcoming financial barriers and discovering avenues to success.